Professional insurance designations indicate a level of education and excellence in your role. Obtaining a designation can enhance your expertise, promote your qualifications to others and help you stand out in a high-demand market. But identifying which designation is right for you right now may not be apparent.

“It’s important to understand what you want to do with your career,” says Michael Platt, Business Operations Analyst for Argo Group.

He researched insurance designations at length before deciding which ones were best for him as an early-career professional. He leveraged downtime during the pandemic to acquire the six he now holds:

- Chartered Property Casualty Underwriter (CPCU)

- Associate in Risk Management (ARM)

- Associate in Surplus Lines Insurance (ASLI)

- Associate in Reinsurance (ARe)

- Associate in Insurance Data Analytics (AIDA)

- Associate in Insurance (AINS)

Michael suggests getting at least one certification as early in your career as possible before your responsibilities increase and personal obligations intervene. The following designations are his recommended starting points for new insurance professionals.

Three designations for new brokers

Associate in Insurance (AINS)

Early-career producers can show their mastery of insurance basics in as little as three months with the Associate in Insurance (AINS) designation. This is a quick win for professionals who want to build confidence and increase credibility.

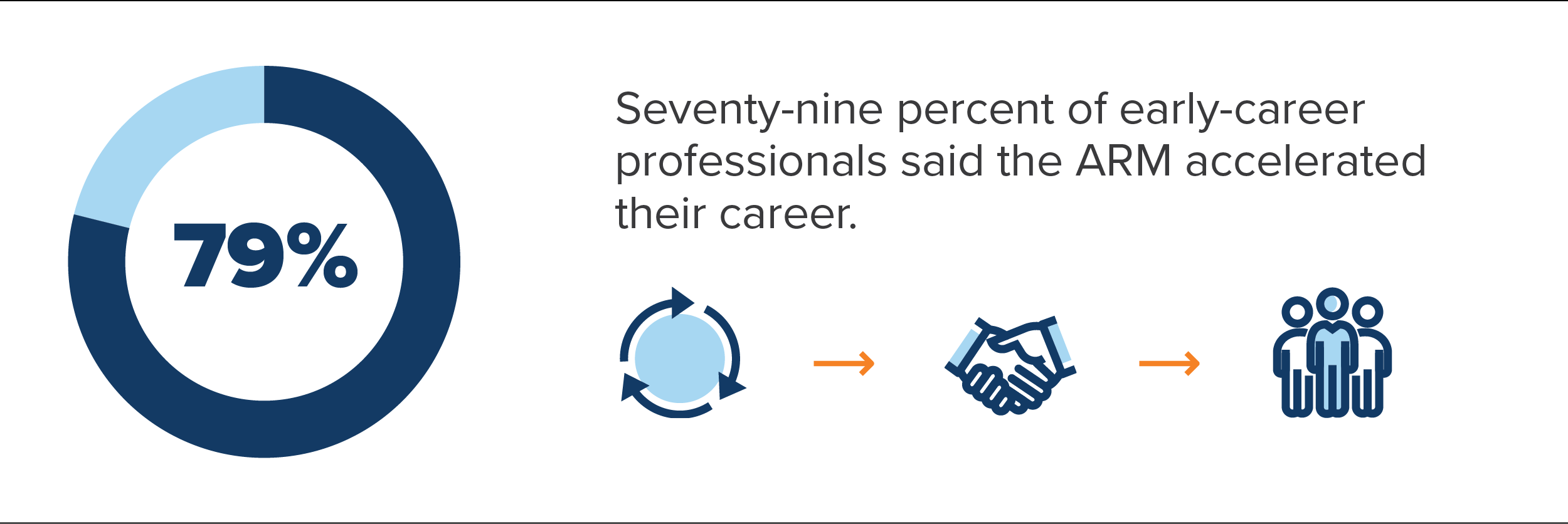

Associate in Risk Management (ARM)

The Associate in Risk Management (ARM) designation provides an introductory but holistic understanding of assessing and treating risk. Coursework can be completed in nine to 12 months.